The dynamic table uses many of the same assumptions in the conventional tables (with a few key exceptions), but it also includes the impact of the economy on taxpayer income. Treasury, the Joint Committee on Taxation, and the Congressional Budget Office.

Conventional distributional tables are constructed using many of the same methods and assumptions employed by the U.S. The tax calculator produces two types of distributional tables: conventional and dynamic. The tax model also relies heavily on data from the Bureau of Economic Analysis, the Federal Reserve, and the Congressional Budget Office to make projections for other federal taxes. This allows the tax calculator to estimate how different proposals impact individual income tax revenue. taxpayers and contains more than 150,000 sample tax returns that represent the population of more than 150 million taxpayers. The PUF is a representative sample of U.S. The main data source for the tax calculator is the Internal Revenue Service’s 2011 Public Use File (PUF), the latest available information. The tax model produces estimates of federal tax revenues, marginal and effective tax rates on different sources of income, and the distribution of the tax burden.

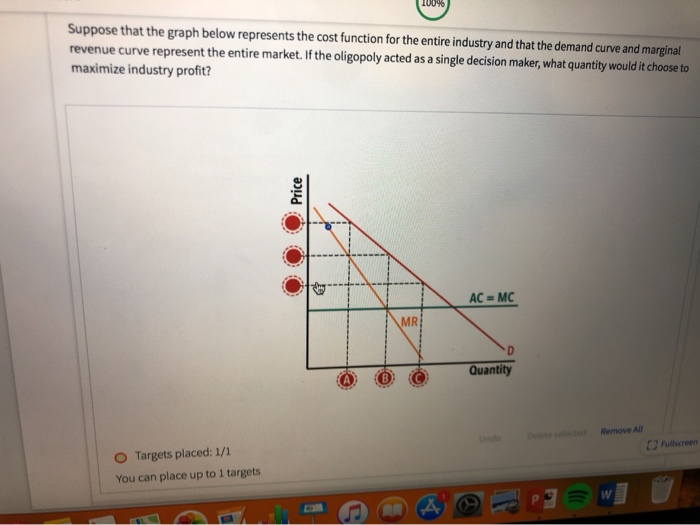

#Marginal revenue graph builder simulator

The tax simulator includes a detailed individual income tax calculator and tax models for the corporate income tax, the payroll tax, value-added taxes, excise taxes, the estate tax, and miscellaneous taxes and fees. The starting point for Tax Foundation estimates is the output from the tax simulator. The Tax Foundation model can produce two types of estimates: comparative statics (i.e., long-run estimates), and year-by-year estimates over the 10-year budget window. The Tax Foundation General Equilibrium Model has three main components that work together to produce estimates: a tax simulator, a neoclassical production function, and an allocation or demand function. Second, it can provide more detailed annual estimates of how the economy adjusts to changes in tax policies, allowing for more detailed dynamic results. First, it places economic results in a broader context by providing estimates of how tax changes impact economic aggregates such as consumption, savings, investment, and the trade balance.

The General Equilibrium model improves upon on the previous Tax Foundation model in two significant ways. Lastly, it can produce estimates of how different tax policies impact the distribution of the federal tax burden on both a conventional and dynamic basis. The model can also produce estimates of how policies impact measures of economic performance such as GDP, wages, and employment. The model can produce both conventional and dynamic revenue estimates of tax policy. The Tax Foundation has developed a General Equilibrium Model to simulate the effects of tax policies on the economy and on government revenues and budgets.

0 kommentar(er)

0 kommentar(er)